Mobile banking was on the rise even before the pandemic, but its adoption further accelerated in the year 2020.

Sessions for banking and payment apps in the U.S. rose 27 percent from 2019 to 2020. 78% of U.S. adults preferred banking through a mobile app or website, as of 2022.

Statistics show that even before the pandemic, two-thirds of American smartphone users had one or more financial services apps and 55 percent of consumers had at least one full-service banking app.

Consumers across generations, tech literacy levels, and financial statuses are increasingly turning to mobile banking as in-person branch visits decline in popularity. The way consumers interact with banks is shifting and financial institutions are expected to digitally emulate every facet of the brick-and-mortar banking experience, seamlessly and securely. A well-oiled communications strategy is the key to meeting these needs.

Fortunately, push notifications help pave a seamless user journey and provide the caliber of communication and service that consumers expect from banks. They hold an important place in your communications strategy, by further connecting the array of services and solutions you provide as a mobile banking app, while building users’ trust and improving brand perception.

Mobile push notifications are indispensable to your app’s success as they keep users engaged with their personal finances, foster customer relationships, and deliver guidance and support on the go.

We’ve outlined five ways to use push notifications to connect with your users across your mobile banking ecosystem.

1. Transactional Updates

Informing your users of their transactions, whether big or small, should be a major priority within your communications plan. Deliver transactional updates to users on the go to keep them in the loop at all times. These practical, instant updates play a daily role in building customer relationships by providing utility to end users and drawing their awareness to spending behaviors. They also serve to build trust in your brand and strengthen brand perception.

Send these notifications when a transaction clears or fails to process. Use them to notify users when a transaction takes place, such as a cash withdrawal, mobile deposit, wire transfer, or payment. Receiving a push notification confirming a transaction reassures users that their payment went through, which provides them peace of mind as they go about their day. Alternatively, if a payment was declined, a check is on hold, or if a user has exceeded their overdraft limit, a real-time notification will keep them informed and primed to take the appropriate next steps.

Broadly, transactional notifications create a more seamless user experience by linking together different channels and better connecting digital and in-person customer "touch points" in a meaningful way. This elevates the overall customer experience and can inspire confidence in your brand.

2. Security Alerts

Flagging fraud assuages many users’ number-one concern when it comes to mobile banking — security. Send security alerts to keep users informed of any suspicious activity occurring across their accounts.

Users will appreciate being able to spot fraud faster and take the proper action to protect their accounts. Send users an eye catching notification when a potentially suspicious charge occurs and prompt them to confirm whether they were responsible for the transaction. Phrase and format your security alerts with urgency and clarity, encouraging users to take immediate action. Doing so will make it easier for users to confirm the fraudulent transaction and get timely support to protect their account. In addition to streamlining the support process, this proactive communication strategy will give users peace of mind and foster trust in your institution.

When formatting a security alert message, prioritize urgency and clarity. Embed a clear call-to-action (CTA) in your message and prompt users to take the appropriate next step, whether it’s deep linking the user to the correct location in your app or prompting them to call a support number or send a text.

3. Major Account Updates

Apart from updating users on daily transactions, mobile push notifications can also notify users of major changes to their accounts and remind them to routinely monitor their account and investment histories. With mobile push, urge users to review their account statements, track their term deposits, review loan or card statements, and access investment statements.

Users will appreciate timed reminders that their credit card will expire in 30 days, they’ve successfully opened a new account, or that their monthly statements are ready for their review. Monitoring account updates and routinely reviewing their loan, card, and investment statements will deepen your customers’ understanding of their finances and keep them coming back to your app. Sending gentle reminders for users to perform these actions keeps your institution top-of-mind. Consider sending these types of messages on timed intervals. You may remind customers to review their statements monthly or check their balances weekly.

4. Bank Communications

For your mobile app to mirror the brick-and-mortar banking experience, you’ll need to seamlessly connect users with their wealth management teams on the other side of the screen.

Most mobile banking apps have incorporated some form of secure messaging into their platforms, but facilitating real-time responses is a challenge. Push can easily inform your users that your team is there for them, which instills trust and builds positive brand perception. Push notifications can keep your users closely connected with their customer relationship teams while they’re engaged in other tasks outside your platform. Send your users a push when they receive a secure message on your app or a reminder before their scheduled video call with a banker to enable efficient communication and decrease delays in the conversation.

If your institution provides around-the-clock support, a push notification is the best way for you to reach users as they are going about their busy day. This way, users don’t have to open your app to check for a reply, thereby reducing the chance that they’ll miss a message.

5. Financial Planning, Support, and Investment Tips

In addition to removing friction in your users’ day-to-day banking activities and communications, mobile push notifications are an optimal way to connect users with additional resources, such as support content, educational articles, and informational videos.

Send push notifications that link to educational content on topics such as loan types, savings best practices, expense management, long-term financial planning tips, and investment advice.

Sharing content that empowers your users builds trust with your brand and can increase the likelihood they will engage with you for additional services.

You can also use these notifications to link users to appropriate support resources based on customer journey milestones. You may, for example, send a sequence of support articles to a user who registered for an account the prior week. This way, you can encourage users to familiarize themselves with your platform and features.

While using data such as customer milestones is beneficial to your user experience, take caution in using personal data to push offers or marketing messages. Because financial institutions deal with Personally Identifiable Information (PII), protecting and respecting user privacy and providing flawless data security is important. As you build you messaging strategy, carefully review privacy regulations and make sure that your strategy aligns with regulatory requirements.

More Ways to Enhance Your App Experience

Push notifications are an important piece of your communication strategy, but there are a variety of other ways to build strong customer relationships and create a seamless app experience. A clear and educational onboarding process can help to engage users, promote core app features, and boost long-term retention. Learn why your app onboarding experience matters and how to set your users up for success by checking out this article: How to Build and Effective Mobile App Onboarding Process.

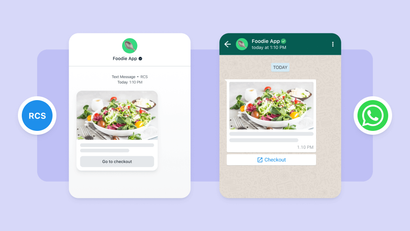

Get Started with OneSignal

OneSignal is designed to help you send notifications and seamlessly manage your user communication across every channel, including mobile push notifications, web push notifications, bulk SMS, in-app messaging, and email. Our platform is quick to set up and makes it easy to customize and automate your messaging strategy, without doing any development work. In addition, our unparalleled security, privacy, support, and message deliverability have earned us the trust of many Fintech companies. Visit our pricing page to compare plan options or bypass the conversation and create a free account to try it for yourself.

Create a Free Account