This post was guest authored by Peter Meinertzhagen, Content Marketer at RevenueCat.

Growing a subscription app has never been straightforward, and the challenges are shifting. User acquisition costs are climbing, competition is increasing, and consumer behavior keeps evolving. This blog pulls together insights from RevenueCat’s 2024 resources — including the State of Subscription Apps report, Sub Club podcast, webinars, and guides — to highlight the strategies apps can use to adapt and grow sustainably.

From optimizing paywalls to scaling with organic growth engines, these trends focus on what’s working now and how subscription apps can build for the future. Let’s get into it.

Localization and regional strategies: Unlocking growth in key markets

Think local to scale global in 2025. As highlighted in RevenueCat’s State of Subscription Apps (SOSA) report and Tammy Taw’s talk at App Growth Annual, success in new markets depends on aligning pricing, SKUs, and buyer experiences with local preferences. Markets like Japan and South Korea demonstrate the potential of such strategies, especially with their strong performance on Android and in-app purchase (IAP) monetization.

RLTV (Realized Lifetime Value) for 2 weeks and 60 days of earnings after download, broken down by region. Both Japan and South Korea seem to monetize Play downloads better, which – due to Samsung’s local dominance – was expected in South Korea, but is surprising in Japan.

Data shows that regional differences in buyer behavior can unlock significant revenue opportunities. The SOSA report highlights Japan and South Korea as standouts for Android monetization, while North America leads in subscription revenue. Tammy Taw’s findings emphasize the nuances within buyer segments: hybrid buyers (those who use both subscriptions and IAPs) represent only 7% of users but generate 25% of total revenue. Apps that understand and cater to these behaviors will outpace competitors.

- Google Play dominance in Asia makes Android-specific strategies crucial. In Japan and South Korea, the emphasis on IAPs aligns with cultural preferences for flexible, standalone purchases over ongoing commitments.

- North America’s subscription focus remains a benchmark for refining pricing and packaging. Apps can learn from this to adapt their offerings for high-intent buyers in other regions.

How to localize with impact

- Segment your buyers by region and behavior: As Tammy Taw pointed out, hybrid buyers are a small but lucrative segment. Use data to identify these users and design offers (e.g., limited-time passes or consumables) that complement their habits without cannibalizing subscriptions.

- Customize SKUs for local markets: SOSA data reveals that monetization preferences vary widely. Align your strategy with regional tendencies, such as introducing flexible IAP bundles in Asia or multi-tiered subscriptions in North America.

- Experiment with localized pricing: Adjust pricing tiers to fit local economic contexts. For example, weekly plans can target lower-intent buyers in emerging markets, while premium annual tiers appeal to higher-income users in North America and Europe. Learn more about localizing your pricing in our webinar with Jacob Rushfinn.

- Enhance user journeys with dynamic offers: Leverage acquisition source and onboarding behavior to present offers tailored to user intent. Tammy Taw’s insights show that guiding users between buyer segments—like turning hesitant buyers into committed subscribers—can significantly increase LTV.

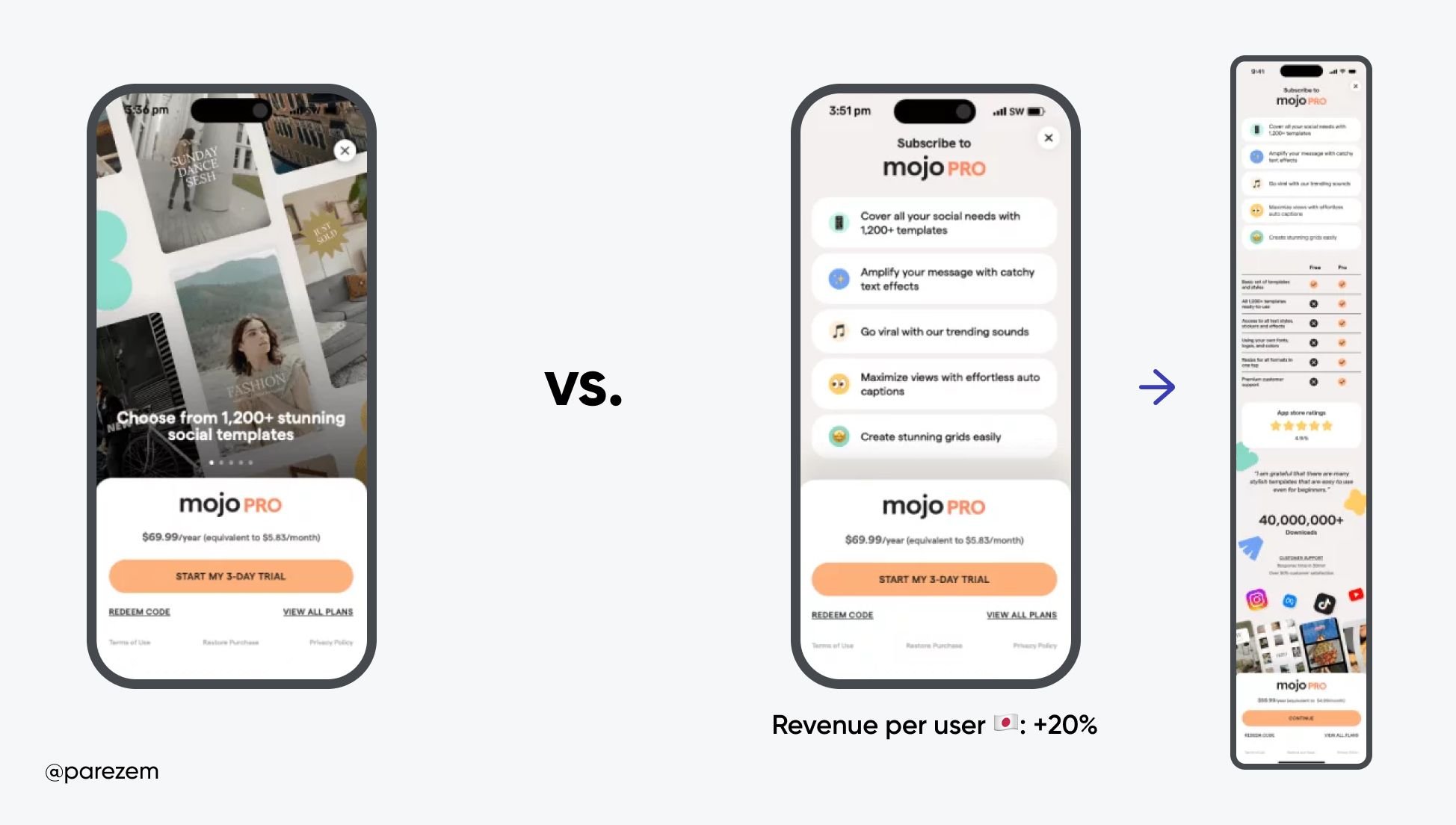

Social video app Mojo uses a longform paywall in Japan to great effect: +20% in revenue per user

Localization means a lot more than translation — to scale growth globally, apps need to adapt their pricing and packaging to what works best for local markets.

Organic growth engines: scaling apps without reliance on paid ads

Rising costs, shrinking returns. With app stores becoming more saturated and paid acquisition channels delivering diminishing results, the challenge of scaling subscription apps is growing. For many, the solution lies not in spending more but in rethinking how they attract and engage users.

In a recent webinar, Phil Carter highlighted how apps like AllTrails and Ladder are overcoming these challenges by creating sustainable organic growth engines.

How AllTrails used SEO to drive high-intent traffic

AllTrails built an extensive, searchable database of hiking trail information, catering to users actively seeking outdoor experiences. By aligning its content with high-intent search terms and optimizing for SEO, the app created a low-cost, long-term acquisition funnel. This strategy provides consistent traffic and reduces dependence on paid campaigns.

What makes this strategy successful?

- Evergreen content: Once optimized, trail information consistently attracts search traffic without ongoing advertising costs.

- High conversion intent: Visitors actively searching for trail information are more likely to convert into users and subscribers.

- Community engagement: User-generated content, like reviews and photos, amplifies SEO performance while building trust and social proof.

The result is a low-cost, self-sustaining acquisition funnel that reduces dependency on paid campaigns while consistently delivering high-intent traffic.

How Ladder leveraged TikTok to engage new audiences

When Ladder entered the crowded fitness space, they faced tough competition and early setbacks. Attempts to scale through traditional paid channels like Facebook and Google didn’t deliver the results they needed. Instead of doubling down, they took a step back and leaned into their unique strength: their group coaching model, with influencer coaches at its core.

By shifting focus to TikTok, Ladder unlocked a platform primed for their strategy. Coaches became the face of their brand, using authentic, high-energy content to drive interest and engagement.

Here’s what worked:

- Coach-led storytelling: Coaches shared personal success stories, fitness tips, and community wins, making the content feel personal and trustworthy.

- TikTok-first content: Short, engaging videos tapped into the platform’s trends, helping the brand reach audiences where they were already active.

- Iterate and invest: As organic traction grew, Ladder fine-tuned its strategy, introducing Spark Ads and brand campaigns to scale their presence effectively.

- High-value positioning: With a $30/month price point, Ladder’s premium positioning allowed them to balance acquisition costs with strong lifetime value (LTV).

By leaning into TikTok’s strengths and focusing on what made them different, Ladder not only built an organic growth engine but also set the stage for scalable paid acquisition. This mix of authenticity and strategy turned TikTok into a major driver of growth.

What you can do

To scale your app sustainably, build an organic growth strategy tailored to your product and audience. Apps with rich content opportunities can emulate AllTrails’ SEO strategy by developing resources aligned with high-intent searches. Meanwhile, community-driven apps can look to platforms like TikTok or Instagram to connect authentically through shareable, relatable content. By investing in organic channels, you’ll reduce acquisition costs and build a scalable foundation for growth.

Maximizing conversions with onboarding paywalls

Onboarding is a lot more than just a way to introduce your app: it’s your first opportunity to convert users into paying subscribers. According to SOSA 2024, most trial starts happen within the first 24 hours, and apps like Mojo report that onboarding paywalls drive over 50% of their trial conversions. This makes early paywall placement a critical trend for 2025.

The onboarding phase is when users are most motivated. They’ve just downloaded your app with a specific problem to solve or need to meet. Presenting a paywall at this high-intent moment allows you to demonstrate your app’s value while user interest is still fresh. Delaying paywall placement risks losing users who may not return.

What successful apps are doing

- Mojo’s onboarding strategy: As highlighted in the essential guide to paywalls, Mojo places a paywall during onboarding to highlight its premium features and offer a free trial. This approach generates over half of its trial starts while lowering the perceived risk of commitment.

- Clear, focused messaging: Apps that clearly communicate their benefits during onboarding — not later — see higher conversion rates and more engaged subscribers.

Check out OneSignal's User Onboarding Toolkit for tips, strategies, and tools to build an irresistible and effective onboarding experience across channels.

What you can do

- Introduce a paywall early: Place a paywall strategically during onboarding, ideally after showing users how your app solves a key problem.

- Consider offering a free trial: Free trials can reduce risk and encourage users to explore premium features before committing to payment. However, there’s growing discussion around skipping free trials entirely, especially for apps with a clearly defined niche or high perceived value. Testing both approaches—free trials versus immediate subscription offers—can help determine what resonates most with your audience.

- Optimize your messaging: Keep your value proposition simple and direct. A/B test different layouts and messages to see what works best.

As user acquisition costs climb, onboarding paywalls will become even more essential for subscription apps. Apps that prioritize this early conversion point will be better equipped to grow sustainably and build a loyal subscriber base.

Rethinking web-to-app: Opportunities beyond fee savings

Web-to-app strategies are having a moment. Over the past year, they’ve become a hot topic in app growth circles, but many developers are jumping in for the wrong reasons. As Thomas Petit explains on the Sub Club podcast, the real potential of web-to-app lies not in fee savings, but in broader benefits: unlocking new acquisition channels, tailoring user journeys, and gaining more control over customer relationships

Other benefits of web funnels include better renewal rates than on the App and Play Stores. Source: RevenueCat

Why web-to-app works

- Tailored experiences boost conversion. Thomas highlighted how Ladder uses a web-based survey to segment users early in the funnel. By identifying high-intent personas, Ladder optimizes its ad campaigns on platforms like TikTok and Instagram, feeding data back to the algorithms to improve targeting and performance. This approach shows how web-to-app can do more than replace app store billing—it can make acquisition more efficient.

- Expanding into web-first channels. Platforms like Pinterest, Taboola, and Outbrain offer valuable audiences, but they’re not ideal for direct-to-app-store strategies. As Thomas discussed, apps like Blinkist use content-focused ads to lead users to rich landing pages, creating smoother transitions to the app. For apps that rely on storytelling or niche audiences, web-to-app is key to making these channels work.

- Flexibility for cross-platform users. Web-to-app isn’t just for driving iOS and Android downloads. Thomas shared how apps use the web to target Amazon Appstore users or Android devices that lack Play Store access. With device-based optimization, apps can direct users to different app versions or even alternative experiences that best fit their needs.

- Owning the transaction. While saving fees might not be the core benefit, owning the billing relationship has perks. For instance, some apps offer partial refunds during cancellations—a retention strategy impossible with app store billing. By keeping users happy and engaged, web-to-app strategies can increase lifetime value far beyond the savings on fees.

How to experiment with web-to-app

- Start small. You don’t need a full web app to get started. Many apps begin with simple landing pages to qualify leads or collect data, improving their ad efficiency while driving users to the app.

- Explore untapped channels. Platforms like Pinterest and Taboola are great for storytelling-driven campaigns. Use web-first experiences to unlock these channels and connect with new audiences.

- Segment by device. If your app performs better on newer devices or specific platforms, use web flows to route users accordingly, ensuring better experiences and higher conversion rates.

Why this matters in 2025

Web-to-app has been around for years, but it’s hitting its stride as more developers explore its potential. By going beyond fee savings and focusing on user experience, channel expansion, and tailored journeys, apps can unlock new opportunities in increasingly crowded ecosystems. For apps willing to experiment, web-to-app offers a path to sustainable growth—and a competitive edge heading into 2025.

Verticalized and deep: Winning with category leadership

Success in 2025 will come from depth, not breadth. As highlighted on the Sub Club podcast, apps that specialize and deliver unmatched value in specific niches—what Eric Crowley terms “verticalized and deep” products—are outpacing generalists. In a world where platform giants like Apple are integrating baseline features into their OS, only apps that offer premium, tailored experiences will retain and grow their audiences.

Why category leadership matters

Platforms like Apple and Google tend to build features that are broad and shallow, catering to the average user. This approach creates opportunities for apps to go deep and specialize in ways that platforms cannot. By addressing specific user needs with unmatched functionality, category leaders create strong differentiation and build a loyal user base willing to pay for premium features.

- Flo’s leadership in female health stems from its lifecycle approach. The app supports users at every stage of their health journey—from tracking first periods to navigating menopause. This depth ensures Flo remains essential, even as Apple’s Health app introduces basic period tracking.

- AllTrails excels in hiking by offering detailed trail maps, user reviews, and photos. With features like curated trail guides and social engagement, it continues to attract high-intent users despite Apple Maps adding hiking paths.

How to become a category leader

- Double down on niche expertise: Offer features that go beyond platform-level functionality. For example, if Apple introduces hiking maps, prioritize community engagement, detailed reviews, or pro-level tools like offline access.

- Build community loyalty: Apps like Strava thrive by fostering user communities. Features like leaderboards and social sharing enhance stickiness and drive organic growth.

- Expand your value proposition: Use product extensions to capture more value from loyal users. Duolingo’s family plans and Flo’s premium health modules are excellent examples of how to grow without relying solely on new users.

- Invest in user experience: Platforms like Apple focus on general usability, leaving room for category leaders to excel in design and user experience for their target audience.

Takeaway for 2025

Being the best at solving a specific problem builds trust and loyalty. This focus also creates opportunities for additional revenue streams, such as premium upgrades or adjacent features, helping apps achieve positive net revenue retention (NRR)—a rarity in consumer subscriptions. By becoming indispensable to your users, you can fend off platform-level competition and grow sustainably.

By focusing on your niche and exceeding user expectations, you can drive both growth and retention—securing your place as a category leader.

Key takeaways for subscription apps in 2025

- Localization matters more than ever: Tailor pricing, packaging, and user experiences to fit regional preferences and unlock new revenue opportunities.

- Organic growth is the long game: Invest in strategies like SEO and social platforms to build sustainable, cost-effective acquisition channels.

- Onboarding is your conversion engine: Early paywalls and clear value propositions drive higher trial starts and long-term subscriber growth.

- Web-to-app is evolving: Beyond fee savings, it’s a powerful tool for tailoring user journeys, expanding acquisition channels, and owning customer relationships.

- Go vertical and deep: Success lies in being the best at solving a specific problem, creating value users can’t find elsewhere.